News

2 Feb 2018

Biz Talk – Forget Failure, Fink Fortune!

Subscribe to CX E-News

Regulars – Biz Talk

Forget Failure, Fink Fortune!

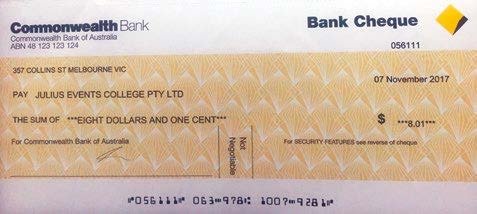

After last months depressing rant I had many sympathetic calls and messages but that wasn’t the motivator behind chronicling my $1.5 million loss on the College dream. Indeed the article must have been noticed, because in the old snail mail came an envelope with a good old fashioned cheque inside. A cheque from that exact same time, which reduced my losses!

As of now I am only $1,499,991.99 out of pocket! It was damn strange to get a refund of $8.01 from the bank just as I published that story. They apologized for overcharging me (and a million others) for some fee or charge. I framed the cheque rather than bank it, since it is poignant and bizarre. I also can’t bank it, as the college company no longer exists.

This month we’re headed in the other direction. It’s time to talk turkey as we board the gravy train. Yup, the goose is fattened and you need to loosen up the belt as your hard earned efforts reap fruit and your waistline bulges. The metaphors are gushing, like champagne from the magnum or flowing chocolate from the dessert fountain.

We’re talking about profits, baby, and your corpulent excessive wages. Lifestyle be damned, we’re gonna live beyond our means – at least until someone (like an administrator or your daddy) stops us!

Seriously though it’s a funny balancing act when you work for yourself. How much do you pay yourself?

A single shareholder business – like my media conglomerate – really is no more than an extension of you (me). Even if it is a separate entity, by way of incorporation. It has its accounts and it submits returns and – if profitable – pays income tax.

Likewise you declare your income, submit your return, and pay your income tax. That is, assuming you earn over the threshold of $18,200. Sadly most of the creative industry do not, but let’s assume you do.

At the ripe and salty age of 60, and having been in business since age 15, you would think I would be a raving expert on tax. I’m a raving writer, to be true, but every year I learn more from my most excellent and well remunerated accountants. I have a ‘top shelf’ philosophy about accountants – always hire the best of kind, and in my case, Watkins Coffey Martin at Roseville are a top notch small business practice.

Before buying my last two properties I loaded up my income in anticipation. I needed to argue – via a very good mortgage broker, who did all the negotiating – that my personal, taxable income alone was all that a bank should consider when assessing me for a mortgage. I had a philosophical objection to the bank pouring over my company balance sheet and past three returns. If I earned enough, as an employee of my company, then that alone is all they need to know.

After all, if you work for an organization and you apply for a loan, the bank can’t ask your employer for its accounts, can they? Noooo.

In both of my cases, a full year taxable income, sufficient to justify the mortgage, was what I produced. It also required that I pay myself all the legal superannuation that went along with it. Naturally it also required more than a year’s forward planning and fortunately things just kind of worked out that way.

As soon as I was in as a home owner, I dropped my taxable income back by half. I was still drawing the same net cash per week, rather what I was doing was paying tax on half of it, each month, in pay-as-you-go. This meant I could elect to only pay super on the taxable component, which helped cash flow.

Naturally there was a reckoning, at June 30, where I would have to declare the extra.

This is where a good accountant does amazing work with dividends and things that I’m not going to write here and that sometimes I just don’t understand.

My accountant tells me a LOT of small business operators, whether company incorporated or sole traders, just draw money and then get to June 30 with no plan.

It can also cascade into provisional tax, where the algorithm at the tax office decides you should pay in advance. That makes the following year a year of tremendous pain.

How you structure your pay affects the eventual value of your business. If you draw almost all the profits out as a reward to you, a future purchaser could fear that the business is only viable with you driving it.

If you are drawing everything out and not reinvesting, eventually your business will look worn out. If it has plant and equipment, those will wear out, hopefully slower than the rate of depreciation!

I had a great equipment rental business in the 1980’s, and the guy who bought it chose to take the profits with very little reinvestment. It now looks very shabby (still in his hands) and presumably still generates some returns because it still operates. I wish I hadn’t sold my name with it, that’s a topic of another story sometime!

So what is a market wage for you? This matters a lot if you have partners, because you’ll need rules in your shareholder agreement about who gets paid what, and when.

A working partner should get a market wage, while a passive partner should be content with their share of the eventual profits.

The greater the wage bill, including your ‘market’ wage, the lesser the profits. Your market wage should be roughly what other people who do what you do, get paid. With average adult earnings running at about $1,608 per week (gross) this year, that’s a good place to start. That is $83,616 plus super, a total package of $91,559.52.

Not too many of my readers earn that kind of money – we are an underpaid industry. We do this for love, apparently.

My accountant has worked many near miracles over the years. He actually negotiated my second divorce. Can you believe that? He took the time to explain to my ex that her valuation of this media empire was somewhat optimistic. He had her interests at heart too, at least in his mind, since he did her tax.

She had some tax problems that she wasn’t properly understanding and he took the time to gently and accurately portray a pathway for her, and a fair value for her settlement alongside.

That kept the lawyers out of the divorce, which in turn meant there was something for both of us, without the endless drip or outpouring of legal fees.

Another pleasant surprise was that the house we had shared had a large depreciation allowance due to the extensive renovations we did to get it large enough for our collective four daughters. I had no idea, but certainly appreciated a five figure deduction!

If there is any take-out from this, it is that you really always should retain – and talk regularly with – a top notch accountant. If they don’t communicate at your level, get another one.

Want more Biz Talk? Head over to CX Magazine and punch ‘Biz Talk’ into the search bar. All content is free with a one-time email sign-up.

This article first appeared in the print edition of CX Magazine December 2017, pp.30-31. CX Magazine is Australia and New Zealand’s only publication dedicated to entertainment technology news and issues. Read all editions for free or search our archive www.cxnetwork.com.au

Subscribe

Published monthly since 1991, our famous AV industry magazine is free for download or pay for print. Subscribers also receive CX News, our free weekly email with the latest industry news and jobs.