News

3 Jun 2020

The effects of the pandemic: Business operator survey

Subscribe to CX E-News

“The only certainty is uncertainty.”

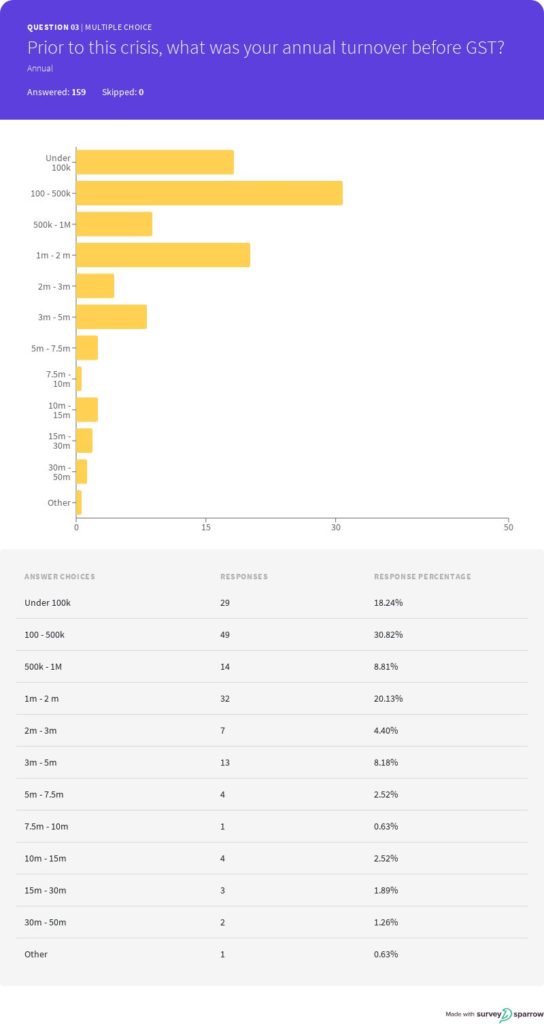

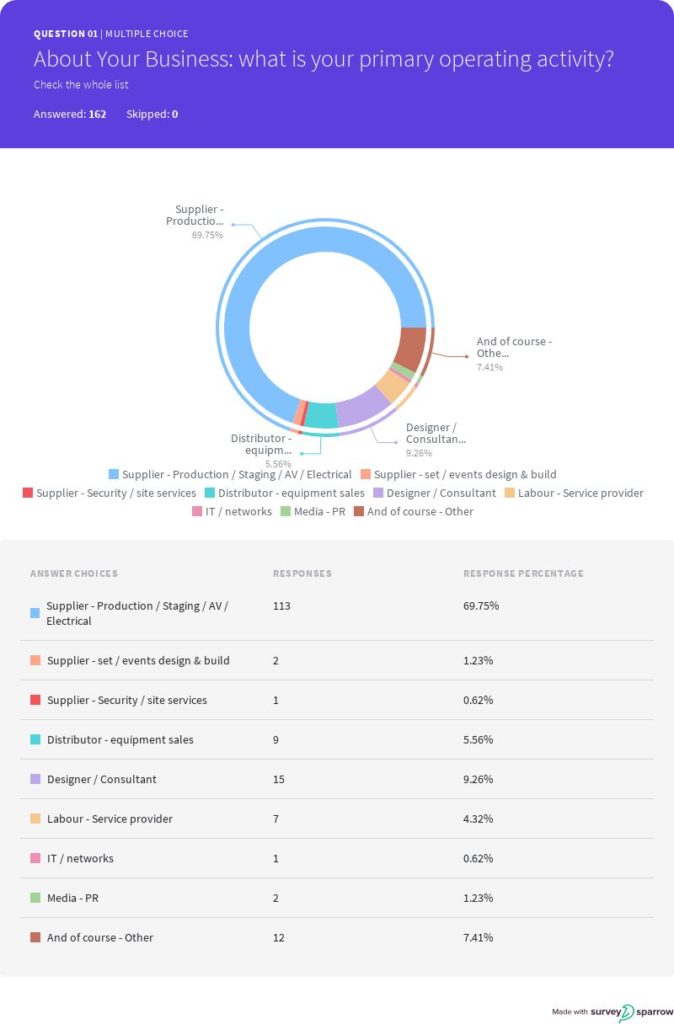

In May, Julius Partners published a survey aimed at suppliers and businesses operating in the supply side of entertainment technology, shows and installations. 162 responses came with almost 70% selecting this category: Supplier – Production / Staging / AV / Electrical. The next largest group were Consultants, at 15%.

131 business owners responded to our question: “What REDUCTION in turnover do you predict in your first year after reopening?”

The answer is 49.57% – let’s say 50%. That’s 50% less gross money they expect to see. As for any current increase in turnover, only two of 162 reported an increase.

We asked if any staff or contractors had actually acquired COVID-19, and two of 162 reported they knew of this occurring.

So, in the opening days of the pandemic, audiences were not likely spreaders – significant when you consider a few huge and sweaty events, like the Madi Gras Party, happened right on the edge of the shut-down.

59% managed to reduce costs. 36% have not. Here’s some commentary on that: “We reduced insurance coverage on equipment not being used. Deregistered all trucks. Cancelled garbage collection.

“The rent we reduced to zero as our super fund owns the property we rent. Directors are working for free.”

Many made practical cuts: “Reduced rent to a quarter with landlord, reduced insurance and paused it for four months, received a rebate on our power bills, paused our landline phone and internet with Telstra and use our mobile phone data for internet with Optus”.

Rent reductions were less common than deferrals, but some reported three or six month’s rent free, while others said the landlord wasn’t interested.

Of those, the likelihood is they will quit the tenancy as soon as they can, so you’d have to wonder about the short-sightedness of some greedy landlords.

As to the banks, some reported good outcomes, others not so good. Most say that of any loan repayment suspensions, the interest is just capitalised on, so it adds up in the end.

A few report that they have been able to set up a government backed loan with no repayments until “it is over”. The interest rate is 4.5%. Encouragingly, a significant minority of responses reported no bank loans and are well capitalised, probably having experienced the GFC in 2008.

As to the recovery of their business, the overall mood is gloomy. It will be slow, and many said that some form of diversification was either helping them now, or a thing they would need in order to grow out of this.

Frontline: Business operators tell their story…

“At the beginning of March we were on track for the 19/20 year to be better than average. When it hit, all the remaining jobs for March, April, May and June cancelled within three Days (approx $350K ). Our last show was on March 18, and we closed the doors on March 23, when the last of the touring equipment was returned. All the casuals were stood down and the full time staff were instructed to use up leave entitlements. We had also had a number of events cancelled in February due to poor ticket sales as a result of the bushfires.”

“Once the JobKeeper scheme was confirmed, all our casuals and full time staff were eligible to be included in the payments. The casuals have all received the full JobKeeper amount. The full time staff have used the leave entitlements to top up the JobKeeper amount to maintain their usual salary value until leave runs out.

“Until social distancing and mass gatherings are returned to pre COVID-19 arrangements, it will not be viable for indoor theatre-style or even outdoor events to resume in a cost-effective way. This also assumes we can find an audience with enough disposable income to afford tickets. I am hopeful we may see some of the smaller musicals and concerts resume by October, but January 2021 might be a more realistic target to be aiming for. If that is the case, the JobKeeper scheme will need to be extended or staff will be stood down again to preserve the viability of the business.

“Before closing we paid all our suppliers in full and have continued to pay everything within seven days of receipt. Unfortunately, I cannot report the same treatment from many of the larger hire companies who still have not paid their February invoices for crosshires we provided to them. Some have indicated they cannot pay and expect creditors to provide an interest free loan until cash starts to flow again. I would have said trading while insolvent was occurring in some cases before the COVID-19 crisis hit.”

“I lost $500,000 in bookings in 24 hours. Turnover for April was $80. We were a longstanding profitable company. Soon we will be bankrupt along with many, many more.”

“We are a Pty Ltd company providing technical staff for outside broadcast. All sport has been postponed or cancelled temporarily, so a number of lucrative overseas jobs (the Olympics, Wimbledon) have been cancelled, and domestic sport, if or when it recommences, will have very limited staff required. There are too many crew to sustain with limited roles. I can’t imagine how the industry will recover.”

“I manage a theatre at a school. Everything has stopped, the venue has been mothballed and I have been moved to another… department until the Government lifts event bans. All income has been lost. But I am fortunate to remain employed on full pay, albeit in a position I wasn’t hired for.”

“International work has completely gone for now. Potential clients are fishing for ideas, but have no confidence to pay us to execute them. We’re keeping staff busy and clients happy by helping them try things, but it won’t last post-JobKeeper. I see a huge desire from clients for events to resume. I think people will get back out there as soon as they can. In video shoots, we’re already seeing willingness to get going again within the confines of current restrictions.”

“I’m an individual consultant with local and overseas work, all cancelled. And I cannot leave the country to resume contracts if possible.”

“I’m an independent Sound Designer (Musicals and Theatre), and sole trader. I expect that there will be less work as producers will be wary of putting shows on until a vaccine is found for COVID-19.”

“There should be the ability to put truck registrations on hold. No shows means the truck is not in use… so far six months of rego is useless!”

“We mainly dry rent conference equipment to the meetings industry. My kids want us to just close the door. We probably could see it out over a number of years, but really it is so depressing we may as well dump it and retire. Trouble is the whole world is in the same position. Will probably go to a business broker and sell at a hugely reduced rate as a going concern. We’re just playing it day by day.”

“Sub tenant so no reduction on rents or utilities. Small family business means only one person got JobKeeper. Zero outreach from a single entity (bank, insurance, supplier). Zero outreach from anyone (other than TV ads) for mental health support.”

“95% of our work is in the education sector. The COVID-19 crisis has changed our work mix – much less from hall and assembly PA Systems, and greater campus wide / evacuation systems. We have simply switched from one form of work to another, since both always present more work opportunity than we could ever handle. A significant amount of regional work has also been pushed back.”

“In the 48 hours following the public gatherings restrictions, $2m of projects was cancelled, and a further $1m since then. Incredibly disappointing to continually see large corporations, and known agencies and producers take advantage of vendors during this crisis, low balling on budgets, expecting pre-production and R&D on digital platforms, sharing confidential information, all for little to no return or guarantee of revenue.”

“We operate in three areas of the industry: onsite support, event production (incl video), integration and consulting / design. Despite the 35% decrease in onsite revenue, there has been only a 15% decrease in events as we have been providing webcasting services for 18 years and this strong base has now grown. Our integration arm has slowed, but consulting increased dramatically – we took on extra staff in consulting at the beginning of this calendar year and all staff are fully utilised with the potential of having to hire more.”

“We saw this coming weeks before most, and in early March started talking steps to reduce expenses. We effectively put the business into hibernation a few weeks before Scott Morrison announced that plan. Although it’s a very painful time and I see recovery taking years, I believe the government has acted and is acting for the betterment of all Australians. I have no issues with the business restrictions regardless of how long they affect me.”

“We are a live production supplier based in Sydney with a background in live events dating back 45 years. We also provide installation design and sales services. We own all of our equipment, except leasing two vehicles and a sound system. Our bank has deferred payments for six months. Our business premises landlord would not negotiate our rent, so we have moved to much cheaper premises. We are concentrating on sales and installations until live production returns.”

“The enterprise was in a growth mode. It would have been the first year in a number of years that I could draw a personal income. We had been building quality equipment, supporting local initiatives out to as far as 600km from base, all the while with a very low debit overhead. Cash at hand was low too, but the prospective job base had grown to encourage us that we were doing the right thing financially.”

“With such an urgent industry closure, there was no backup support. It is not likely that this industry will have the quick response to return to productivity until mid 2021. Promoters will be shackled in as to what they can either risk or are allowed to risk by communities, financiers, and regulatory authorities. I am optimistic that there will be a resumption, but the support required will not be there for that duration. Then finding people that want to engage / risk entering this field will be hampered more than previously experienced. We work in a GIG economy.”

“As the owner of a small business I have taken on the responsibility of making sure that all of my team are physically and mentally OK, and that they are surviving financially. I spend countless hours desperately trying to drum up any work to enable us to survive this horrible crisis as well as negotiating with landlord, suppliers and debtors. I am getting no industry support and I sometimes feel that my staff just don’t realise exactly what I am going through myself – the stress, the sleepless nights etc. I am, however, determined that we will survive and still be here when the entertainment industry emerges from this dark place.”

“We have one large job pending – an installation – not what we usually do. We quoted the job before Christmas and subsequently got a PO last week, but our supplier has no stock, and there is no stock globally that I can get hold of. I don’t think that we will have much happening in the hire department until next year.”

“25 year old, historically robust business. Forward bookings wiped off the board within three days of crowd restrictions. JobKeeper and government packages around loans will keep our doors open and our staff engaged, if not being overly productive through until Sept. Hard to see crowds being allowed by then….. that is the uncertainty that keeps us awake at night.

“We have spent years building and upskilling a brilliant team who meet the needs of the region. We would hate to have to say goodbye to any of them, but the reality is that we are geared for work that needs crowds to be economically viable and that may be some time off. We have managed to pick up some installation work, although a particularly good project was lost due to Lotterywest grants being redirected to the COVID-19 crisis.”

“Have never felt more lost. We have grown this business with bliss and tears for so long and it’s our passion. We are now doing furniture removals.”

“We are hanging on. We have to stay positive. We are finding things for staff to do, and we will have a very clean office/warehouse. We split into two teams, two days each. Each team does a welfare check, cleans and sanitises at the start and end of each day. Everyone has their own PPE masks, gloves, soap, towel, cup, plate. We are learning video conferencing and remote collaboration. We are doing welfare checks outside of our team too. It is mentally and emotionally taxing on senior management. We don’t have answers or a plan for the first time in our history.”

“Six months of bookings cancelled in a 24 hour period is something I will never forget. Laying off someone that has done countless 15 hour days for you and have them throw their arms around you and say “It’s not your fault mate” brings me to tears thinking about it. The bills still arrive on a daily basis, about $25k a month to “hibernate” is not a storm I can weather for long.”

“As a sole trader working to support the AV and entertainment industry, my business was hit as hard as those that had to close. I had a couple of jobs at the beginning of March but since then only one has been forthcoming. The other problem I face is sourcing parts to complete repairs. With air traffic severely cut, I have parts on order that still have not left the origin country. Who knows when I will receive them.”

CX Magazine – June 2020

LIGHTING | AUDIO | VIDEO | STAGING | INTEGRATION

Entertainment technology news and issues for Australia and New Zealand

– in print and free online www.cxnetwork.com.au

Lead image: Patricia Valério @pavalerio

© VCS Creative Publishing

Subscribe

Published monthly since 1991, our famous AV industry magazine is free for download or pay for print. Subscribers also receive CX News, our free weekly email with the latest industry news and jobs.